#9 | T-bill Protocols 101

Exploring the key players, adoption metrics, and target audience

Since my last article two months ago, there has been significant developments in the on-chain T-bill space.

Today, we discuss 3 core questions:

Market landscape: Who are the new players and what are the differences?

Traction: How much adoption have we seen for on-chain T-bills since launch?

Target market: Who even uses on-chain T-bills?

Breaking down the top players in the T-bill market

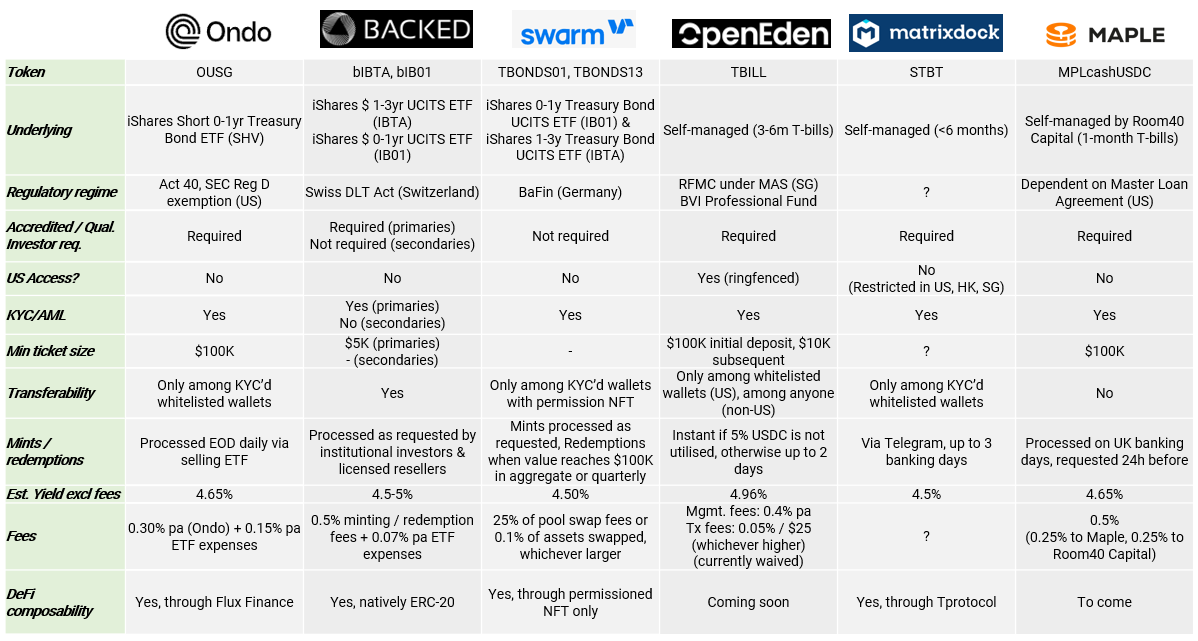

Here’s a summary of the six key players, all of which launched T-bill tokens over the past three months.

By doing absolutely nothing, Blackrock ETFs have dominated the on-chain T-bill market through Ondo, Backed and Swarm. OpenEden, Matrixdock, and Maple's pool delegate manage their own portfolio of T-bills which may increase management fee % especially when TVL is low. Right now, no matter which provider you go to, you’ll be getting similar yields (4.5-4.8%1) with fees ranging from ~10bps to ~40bps.

Each issuer is regulated under a different jurisdictions and hence have varying regulatory risks and different regulatory setups as seen below. Note the lack of transparent info on Matrixdock, not much is known other than the fact that they are a subsidiary of Matrixport.

More interestingly, most of these protocols have found ways to pass on this yield to public DeFi protocols, even though primary issuance only offers T-Bills to accredited / qualified / KYC’d & AML’d investors.

They do it through several mechanisms:

Over-collateralised lending (Flux Finance → Ondo Finance)

As discussed in this article, KYC’d OUSG holders are able to deposit into Flux Finance (a Compound fork) to lend out their T-bill tokens for USDC to leverage up. On the other hand, non-KYC’d USDC holders are able to get a yield ~50bps lower by lending to KYC’d leverage seekers.

Secondary market offering (Backed Finance)

This is simple as liquidity providers (e.g., market makers) mint tokens through Backed and deposit them into DeFi liquidity pools such as Uniswap V3. Non-KYC’d wallets can then purchase these tokens in a permissionless manner.

Wrapping (TProtocol → Matrixdock)

TProtocol wraps the permissioned ERC-1400 T-bill tokens (sTBT) issued by Matrixdock. A KYC’d liquidity provider mints the permissioned sTBT from Matrixdock and opens an on-chain vault on TProtocol. Shares of this vault are represented as permissionless tradeable ERC-20 tokens (TBT).

Given regulations mainly govern primary markets of the protocols, it is yet to be seen how Flux Finance, Backed secondary tokens, and TProtocol will be treated in the eyes of the regulators, especially once they reach high TVLs. They all carry different regulatory risks.

Flux Finance tends to play in the grey zone as technically the non-KYC’d person is just lending out USDC to someone at a rate slightly lower to T-bill yields.

Backed tokens are issued compliantly based on the Swiss DLT Act, but some argue (noting that Stokr is a Backed competitor) that Backed’s tokens are bearer instruments, (i.e. not registered to specific owners and ownership is transferred by physical possession of the instrument), so they may be prohibited by many G20 countries as they are prone to tax evasion, money laundering, and terrorist financing.

As for TProtocol, due to its lack of transparency and documentation, I would advise additional caution and scrutiny from a legal standpoint.

Mandatory note that none of this is legal advice. Please consult a legal professional.

Also note: This is not an exhaustive list of T-bill protocols. Other new players include PV01, Kuma Protocol, Arca Labs, Stream Protocol, Cytus Finance, etc.

How much adoption are these protocols getting?

The existing market cap of T-bill tokens is $168M as of the time of writing, concentrated in Ondo and Matrixdock.

Ondo (OUSG) has a 61% market share ($102M market cap)

Matrixdock (sTBT) has a 39% market share ($66M market cap)

Backed’s bIB01 has a ~$20K market cap and bIBTA doesn’t have a price feed yet

Swarm’s TBONDS01 and TBONDS13 both have ~$8K in issuance

Clearly, both Backed and Swarm are struggling with liquidity and adoption. OpenEden and Maple Finance on the other hand, will be launching later this week.

Nevertheless, I am impressed by the slow but consistent growth of Ondo’s OUSG, given they are the first movers. Out of the $102M worth of OUSG minted, ~28% of them are deposited into Flux Finance. There are only 18 addresses holding >$1K worth of OUSG, hence it is clear that meaningful adoption among whales and institutions is still limited.

Matrixdock’s STBT has also seen consistent step-growth with 30 addresses holding >$1K worth of STBT. I’m speculating that these are Matrixport’s institutional customers who are choosing to hold STBT over stablecoins. As TProtocol is pushing out liquidity mining rewards, there’s ~$7.7M TVL wrapped up in TProtocol vaults.

Who even uses these T-bills?

The key question is: Who would buy T-bills on chain instead of through a traditional brokerage given they already have accounts and there is much more liquidity and lesser regulatory risk?

DAO treasuries where they cannot send USDC off-chain to invest in cash management products using USD as they have to report to the DAO community. On-chain T-bills will allow for the transparency they need.

Crypto startups holding USDC but are offshore and cannot access the US banking system.

Crypto hedge funds which have a mandate to be completely on-chain.

HNWI individuals who are sitting on stablecoins and not looking to deploy in the near-term, looking for low-risk yields. They either do not want to KYC or do not want to go through the tedious and sometimes expensive on/off-ramping process.

Where do we go from here?

On-chain finance is just a more efficient way to do finance. The main problem is the go-to-market strategy and regulations.

We’re seeing startups capitalising on the high interest rates (compared to Aave rates) to introduce tokenised T-bills into DeFi. In the near future, they will likely slowly move up the risk curve and offer investment grade bonds, crossover bonds, supply chain financing, web3 startup / DAO bonds, and other forms of credit.

The space is heating up, in the past week…

Ondo launched a their rebasing stablecoin, OMMF, which accrues interest

PV01 is bringing US treasuries to blockchains with plans for corporate bonds

Maple Finance launched a new cash management pool with US T-bills

Ribbon Earn V2 re-launched their principle-protected product with Backed’s IB01

TProtocol launched their liquidity mining programme on Velodrome

Stream Protocol launched their whitelisted beta for non-KYC’d US Treasuries

The time is now. As always, DMs open for discussions.

rates as of 17 April 2023

Importantly, do we have the market share on the 4 investor groups of Dao treasuries, Crypto startups, Crypto hedge funds and HNW participating in USD168M market cap?