#7 | Unlocking the $150B stablecoin opportunity: How DeFi is bridging traditional securities on-chain

What is Ondo Finance & Backed Finance?

TLDR:

T-bill rates (~5%) have surpassed DeFi risk-free rates (~2%) since mid last year, leading to a unique ~$150B stablecoin opportunity for startups to offer higher yielding tradfi products on-chain

Ondo Finance provides tokenised T-bill ETFs, etc., to qualified purchasers and have launched Flux Finance as a creative way of bridging this yield to DeFi

Backed Finance is a Swiss platform that provides tokenised structured products such as the S&P500 ETF which are freely tradeable in DeFi secondary markets

Stablecoin issuers now hold 2% of all T-bills, so it only makes sense for stablecoin holders get this yield by holding cash equivalents on-chain.

Startups will need to utilise the current high interest rate environment to build early traction, then continue iterating to capture the next billion users.

Let’s talk security tokens

If you were around in the crypto space in 2017, you might remember a wave of startups that were all about “tokenisation”. You would also remember that none of them have taken off since.

There are a few reasons for that.

These startups were mostly built on permissioned blockchains and struggled to gain adoption as early crypto users were playing on public blockchains such as Ethereum. These startups also couldn’t access existing DeFi liquidity, nor leverage DeFi composability as money legos. Stablecoins also weren’t a thing back then - no mass market adoption, neither as a medium of exchange, nor as a store of value.

Now, there are ~$150B of stablecoins sitting idly on-chain.

Sidebar for casual crypto enthusiasts: When I mention stablecoins, you can assume I mean centralised fiat-backed stablecoin like the Circle USD (USDC). Tightly regulated in the US, and no funny algorithms behind it like the infamous Terra/Luna. Here, you transfer Circle $1 in fiat, then they’ll keep your dollar in a bank and give you 1 USDC.

Unlocking the $150B stablecoin opportunity

In traditional finance (TradFi), corporates would not sit on so much cash reserves as these are unproductive asset which get eaten away by inflation. They will hold onto “cash equivalents” which are things like short-term T-bills, commercial paper, or money market funds - financial products with low risk and high liquidity.

The safest of them are T-bills which are often referred to as the “risk-free rate” given they are nearly free of default risk as they’re fully backed by the US government.

The closest proxy to a “risk-free rate” in DeFi is the overcollateralised USDC lending rate on Aave, a money market DeFi protocol. This is because when the collateral value drops to near the value of the loan, the collateral is liquidated and the full value of the loan is returned to the lender.

Just a year ago, the 3-month T-bill yield was ~0% while Aave rate was ~1%, hence stablecoin holders could happily park their USDC reserves on Aave and ignore traditional finance products.

But this isn’t the case now.

As of June 2022, T-bill yields have become higher than Aave USDC yields.

Over the past year, FED policies have driven up the yield of 3-month T-bills to ~5% while DeFi risk-free rates hover between 1.5-2.0%, far below the TradFi risk-free rate.

While this would mean that the rational thing as a crypto startup holding USDC is to convert your USDC into USD and buy T-bills, this presents too much friction (on/off-ramping, opening brokerage/treasury accounts, managing liquidity needs & risk exposure, setting up legal and technical infrastructure, etc.) and also prevents DeFi composability.

Hence, there is a unique $150B opportunity for startups to bring higher yielding traditional finance products on-chain.

Start-ups bridging TradFi & DeFi

1. Ondo Finance

Ondo Finance provides institutional-grade financial products in token form to US and non-US qualified purchasers (someone with $5M+ investments) who have went through the KYC & AML processes and are whitelisted by Ondo. The minimum ticket size is $100K or 100K USDC.

They will launch 3 products (only $OUSG as of Feb 2022), namely:

$OUSG, a tokenised form of the iShares Short-term Treasury Bond ETF (NASDAQ:SHV). AAA rated, currently 4.5% yield-to-maturity

$OSTB, a tokenised form of the PIMCO Enhance Short Maturity Active ETF (NYSE:MINT). BBB- rated, currently 5.7% yield-to-maturity

$OHYG, a tokenised form of the iShares iBoxx High Yield Corporate Bond ETF (NYSE:HYG). BB- rated, currently 8.4% yield-to-maturity

Ondo charges a 0.15% fund management fee on top of Blackrock/PIMCO’s ETF fees (0.15-0.48%). Hence you’ll be paying 0.30-0.63% in fees per year depending on the ETF.

Being a highly regulated entity, Ondo involves many independent parties from buying of the iShares ETF to issuing the Ondo-ETF token. Long story short, when you buy an Ondo-ETF token, you are buying a claim on a fund (regulated in the BVI) that invests in a specific ETF.

Importantly, Ondo tokens cannot be transferred to non-KYC’d accounts, but are tradable between KYC’d accounts which are added to the Ondo whitelist. I think this presents interesting opportunities as Ondo could easily create on-chain finance protocols which only whitelisted accounts can interact with, essentially building a KYC’d walled garden which are forks of existing DeFi protocols.

But… this is so non-crypto native! What about the millions of non-KYC’d crypto users?! Who on earth has $5M net worth and wants to buy $100K worth of ETFs?!

Cue… Flux Finance

1.5 Flux Finance

Non-KYC’d accounts obviously cannot hold US securities.

Hence, the Ondo team had to get creative. They launched the money market protocol Flux Finance, which is a fork of Compound V2 modified to add support for permissioned tokens.

Skip this if you know what Compound is: Compound Finance is a permissionless lending and borrowing DeFi protocol that algorithmically sets interest rates based on the supply and demand in its liquidity pools. It offers over-collateralised lending, so if you deposit $1000 of ETH, you would be able to borrow ~830 USDC. If the value of your ETH collateral falls to ~$830, your ETH will be sold (collateral liquidated) to close your position.

Essentially, Flux Finance allows non-KYC’d users to lend USDC at rates close to T-bill rates (typically T-bill rate minus ~0.5-1%). On the flip side, KYC’d accounts can achieve 8%+ returns by increasing leverage through over-collateralisation with $OUSG tokens (see diagram below).

This is an ingenious mechanism which allows both KYC’d and non-KYC’d folks to achieve higher yield, and to bridge the TradFi yield into DeFi in a compliant manner.

What we’ve seen since launch is that ~$37M has flown into Flux with a supply APY of ~3.7% (vs 2.0% in DeFi). In the long term as Flux/Ondo matures, we expect the “arb” between DeFi/TradFi rates to close as people who used to lend to Compound choose to lend on Flux instead.

Given that rates on Compound are determined by supply/demand, deposit rates on Flux & Aave/Compound will become similar (but with a small delta to take into account the additional smart contract risks & liquidity risks involved).

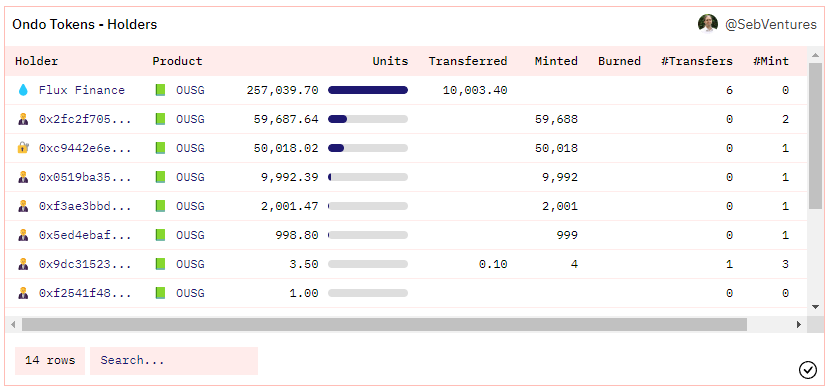

The beauty about on-chain finance is that, well, all the data is available on-chain. Hence if you know some SQL, you can always query the blockchain.

From here we can see that $25.7M of $OUSG (68% of minted tokens) are put into Flux Finance. The rest are held by 5 large accounts which hold $5.97M, $5.0M, $9.99M, $2.0M and $0.998M.

but… what if we want to get non-KYC’d, transferable security tokens?

2. Backed Finance

Backed Finance is a Swiss company that acts as a platform to tokenise structured products that track the value of publicly traded securities. Every bToken issued is backed by an equivalent security held by a regulated custodian. bTokens are not available to US or Canadian investors.

All bTokens are issued in accordance with the Swiss DLT act and can only be sold to KYC’d qualified investors and licensed resellers. These KYC’d entities pay a one-time fee to mint it and can then sell these tokens to non-KYC’d accounts through secondary markets (e.g., decentralised exchanges like Uniswap).

What Backed enables is huge.

There are a lot of people in emerging markets who want to index invest, yet they can’t get access to Vanguard ETFs or even the S&P500 ETF. Backed will democratise access to these products.

In developed countries, Backed will open up 24/7 capital markets for all, introducing interesting dynamics around on-chain bTokens reacting to weekend news and having to re-adjust to Wall Street prices at market opening. It also allows for fractional trading and DeFi composability (e.g., over-collateralised loans) among other things.

Backed can technically issue a bToken for the ETFs Ondo already provides, but currently they have only listed three products with a 100M max issuance volume:

bCSPX: tokenised iShares Core S&P 500 UCITS ETF (LON:CSPX)

bCOIN: tokenised Coinbase shares (NASDAQ:COIN), launched in conjunction with Coinbase’s layer 2 blockchain, Base

bNIU: tokenised Niu Technologies shares (LON:0A54)

Based on Backed’s go-to-market strategy, it is no surprise that most of the existing bCSPX (worth ~$32K) are on a decentralised exchange (Uniswap) pool. They are still in their early days and will need to strike partnerships with market makers and licensed resellers to ensure they have enough liquidity to start engaging the DeFi audience.

3. Swarm, Cytus & Kuma

To prevent this from being a 10-page post, here are brief summaries of lesser known competitors in the space:

Swarm: allows KYC’d, AML’d non-US investors to buy tokenised Apple stock, Tesla stock, 0-1 yr and 1-3yr US T-Bill ETFs. Compliant with German regulations. Launched Feb 2023

Cytus Finance: allows KYC’d, AML’d non-US investors to buy a non-transferrable token which acts as a claim on a fund that invests directly in US T-bills (not ETFs)

Kuma Protocol: issues tokens that represent a claim on a pool of NFTs, which are collateralised by sovereign bonds

Conclusion

This is a unique opportunity to bring traditional finance assets on-chain.

In fact, stablecoin issuers now hold >$80B of short-term US govt debt, or 2% of the market for T-bills, highlighting the expanding role of digital asset players in tradfi markets.

It only makes sense for stablecoin holders get this yield by holding cash equivalent on-chain.

On-chain traditional finance assets (e.g., stocks, bonds, ETFs) have historically experienced a “go-to-market” problem. While stocks on-chain are marginally better due to 24/7 markets, faster settlement, transparency, access, composability, etc., they give rise to potentially bigger problems, such as regulatory changes and low liquidity on-chain.

If a new product isn’t 10x better than an old one, no one will use it.

Hence, start-ups will need to utilise the current tailwind (high interest rate environment) to bootstrap some early traction through existing stablecoin holders, and continue iterating to capture the next billion users.

Thank you for reading! If you’re building something cool, ping me here or here.

Disclaimer: This post is for general information purposes only. It does not constitute investment advice or a recommendation or solicitation to buy or sell any investment and should not be used in the evaluation of the merits of making any investment decision. It should not be relied upon for accounting, legal or tax advice or investment recommendations. This post reflects the current opinions of the author(s) and does not necessarily reflect the opinions of Tioga Capital. The opinions reflected herein are subject to change without being updated.