#2 | Why DeFi makes sense

a response to 0xKyle

My buddy 0xKyle wrote a piece called “Cynicism”, where he asked many VCs at TOKEN2049 a very simple question: “Why are you bullish on digital assets?”. Not many could answer well, but I’m not surprised. Sometimes we’re way too deep into something that we forget to ask “why?”.

Needless to say, this is a question that every single friend & family will ask you if you work in crypto. I had a good conversation with Kyle in Twitter DMs and thought I’d turn it into a quick post.

In crypto, there are a few clear (non-MECE) buckets of use cases: Finance, NFTs, gaming and the metaverse (whatever that means). But to me, the clearest use case which requires the fewest assumptions about the future is DeFi.

It is important to note that the “De” in “DeFi” is a spectrum. It goes from a fully decentralised financial infrastructure requiring no KYC (e.g. Uniswap) to permissioned finance running on a decentralised Ethereum (e.g. Aave Arc).

Why DeFi makes sense

Reason #1: Access to FX, USD and cheaper transactions

I still remember back in the early 2000s, my parents would exchange Malaysian Ringgit for USD through money exchanges and store dollars in cash at home as banks don’t hold retail USD.

Money in many emerging economies (e.g. Indonesian Rupiah, Nigerian Naira, Venezuelan Bolivar) are at risk of depreciation, and easy access to USD will allow everyday people to hedge easily.

At this moment, even first-world countries are affected by currency depreciation (I’m looking at you… GBP & EUR, which both slid ~20% against the dollar YoY). In countries with more mature Fintech, you get services like Revolut which allow you to hold dollars. But there are still limitations there on the per-month limit and access to other currencies.

Remittances & payments are also much cheaper. Normal transactions from wallet to wallet cost a flat gas fee, while decentralised exchanges charge 0.05%-0.3% in exchange fees. Meanwhile, Mastercard and Visa’s fees on merchants are 2-3%. As retail end-users we don’t feel much of this (other than a slightly inflated price for us), but at this point merchants have no choice but to kowtow to the oligopoly. There’s a reason why the chinese takeaway shop only takes cash…

There’s an argument to be made about gas fees on Ethereum being super high right now. However, I think it’s only going down from here with the proliferation of bundled transactions on Ethereum L2s as well as tech advancements on alt-L1s. Furthermore this flat fee is especially useful when transferring large amounts.

Transacting on-chain is just cheaper. This is due to the highly automated nature of it driven by the usage of smart contracts, which reduces labour and operational costs. Don’t take my word for it, read the IMF’s Global Stability Report (or Jack Chong’s summary of it)

Reason #2: A global financial system with pooled liquidity

A global blockchain like Ethereum is great at pooling liquidity. Essentially, any crypto or ERC-20 token you own can be exchanged for USDC through liquidity pools which are now public infrastructure (e.g. Uniswap, Curve). In fact, fully on-chain foreign exchanges are starting to grow (e.g. DFX).

This is not limited to currency markets. We’re also seeing DeFi pulling liquidity from across the globe from a shared financial infrastructure to lend to SMEs in Latin America, Africa and Southeast Asia (e.g. Goldfinch). This is a win-win as emerging markets have the willingness to pay a higher borrow APY and struggle to source liquidity. On-chain lending to off-chain entities through smart contracts also allows for features such as pooling of smaller retail lenders and allowing the lender to choose what rates they are willing to lend at (e.g. on Atlendis, you can choose to lend out just $100 to Wintermute at 12.0% interest).

Reason #3: Faster settlements, 24/7 markets

It’s almost unbelievable that in the age of instantaneous 24/7 information, that public markets and cross-border remittances have “9-5 business hours” and are closed on weekends. Financial infrastructure running on blockchains will enable 24/7 trading of tokenised assets, allowing markets to react to news instantly. This is due to the standardisation of financial securities (ERC-20) and the simplicity of transferring value (a simple ERC-20 token transfer) on a blockchain.

The SWIFT system born out of the 1970s and is not fit for purpose anymore. Updating legacy financial infrastructure is a pain and is risky, hence why 92 of the top 100 banks still run on mainframe computers. Fintech running on SWIFT is a band-aid to the problem

In fact, the de facto standard for settlement in financial markets is “T+2”, i.e. a two-business-days settlement period. The rationale for this delayed settlement? To give time for the bond seller to get documents and for the purchaser to clear the funds required for settlement. Standardising these documents (i.e., security certificates) which represent the bonds and clearing funds on Ethereum would solve these problems and finality will be limited by the blockchain it runs on.

Reason #4: Transparency and efficient accounting

The difference between the 2022 Terra collapse and the 2008 Lehman Brothers collapse is that we could see the entire Terra meltdown on-chain through the destabilisation of the Curve pools. With the Lehman Brothers, we had to wait and trust in the news which may or may not report correctly or accurately.

Obviously there is a whole conversation to be had around privacy on blockchains, but my belief is that there are some tx which should be default private and some public, such as company earnings. In the current day and age, we’re dumbfounded by how people used to have to wait for tomorrow’s newspaper to know the price of a stock. What do you mean you can’t pull out your phone and instantly know the stock price of a company half way across the world?!

I think in the future we’d look back at 2022 and wonder why we can’t just Google a company’s P&L on this very second. “What do you mean we only get quarterly snapshots which are released months after the cut-off date?! How am I supposed to make an informed investment decision based on news months out-of-date?!”

Obviously this would require the entire company to be run on-chain, but a man can dream.

Reason #5: Composability & programmable money

I think this is one of the most under-rated and overlooked aspects of DeFi. We are creating an open finance infrastructure, a one-size-fits-all public API that anyone can build and innovate upon. USDC (tokenised money) can be programmed to stream from wallet-to-wallet or between protocols

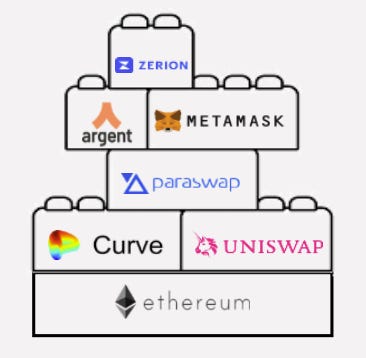

In the composable stack, each DeFi app specialises in one specific function and can connect to all other apps to leverage their unique value-add. This results in more innovation, significant efficiency gains, a richer UX. Case in-point is the hot wallet MetaMask which runs swaps through DEX aggregators (e.g. 1inch, 0x, Paraswap) which aggregates DEXs (e.g. Uniswap, Curve) which runs on top of the Ethereum network.

Compare this to HSBC, Barclays and Lloyds, who all needed to build their own separate, siloed infrastructure.

Money on blockchains is just a better form of money, similar to how we moved from paper money to e-money, the next logical step is to move towards tokenised money - whether it’s a centralised stablecoin (e.g. USDC, EUROC) or a central bank digital currency (CBDC) (e.g. digital renminbi). Although ideally we wouldn’t want CBDCs, at least at a retail level.

Money on blockchains is the internet of value. It is as if we all literally had a wallet, but digitally and can freely transfer value (money, currency) across the internet. Similar to how I could put cash in your physical wallet, now I can put USDC (tokenised cash) into your online wallet.

Case in point is Ukraine raising $54M through crypto rails, bypassing financial institutions. Now you don’t have to set up a Ukrainian bank account, and make your donator’s bank in Eritrea is connected to the Ukrainian banking system, and ensure a certain currency is accepted on both ends. What you do now is the equivalent of taking cash out of your wallet, and putting it into the NGO’s wallet.

Parting words

So, this ended up being a lot longer than expected.

I am an investor, but I am also a skeptic (see my twitter bio). However I think it’s much easier to call every new innovation “useless” and be bearish than bullish. If you’re bearish and things turn out bad - you win, if things turn out well - you also win as you’d be able to benefit from it.

As investors it is our job (and a great challenge) to find that 1 company out of 1000s which can bring value to society (and of course, make money in the process).

It took me a really long time to “get” crypto, because crypto has encouraged speculation and what I like to call, “hyper-financialisation” of everything.

Honestly, it's pretty crazy crypto became a $1T market without solving any real world problem. We’re looking to fund projects that are not “self-referential” and don’t just faciliate the “crypto casino”. If you’re building something interesting, my DMs are open.