I’m a sucker for novel tokenomics. There’s something fascinating about watching crypto protocols tinker with incentives, sometimes in ways that seem brilliant — until they inevitably break. So when Bittensor rolled out its dynamic TAO (dTAO) system on Valentine’s Day (a love letter from constreborn?), I was intrigued.

The idea was simple: a new, “fairer” way to distribute TAO emissions across subnets.

But barely a month in, the cracks are already showing. Turns out, what looks good on paper doesn’t always survive the free market.

How dTAO works

As a refresher, here is a simplified explanation on how dTAO works:

Each subnet has its own subnet token ($SN) which exists in the form of a native TAO-SN UniV2-type pool. Confusingly, instead of “swapping” TAO for SN, they call it “staking” TAO for SN. They are functionally the same, except that you can’t add liquidity into the LP and you can’t trade between SN tokens, eg SN1 → SN2. But you can still do SN1 → TAO → SN2.

TAO 0.00%↑emissions are allocated proportionally to subnets based on their price. They use a moving average price to smooth out price spikes or attempts to manipulate price.

SN tokens also have high emissions with a 21M supply cap, just like TAO and BTC. A portion goes into the TAO-SN pool, and the rest goes to the subnet’s stakeholders (miners, validators, subnet owner).

The amount of SN token that goes into the TAO-SN pool is the amount required to balance off the TAO emitted into the pool, such that SN price in TAO terms remains constant, while liquidity increases.

However, if the math above works out to a number where the subnet receives more tokens than the maximum allowable SN emission (based on the SN emission curve), then it is capped at the max possible SN emission, and hence the price of SN token increases in TAO terms.

The underlying assumption in point (2) of the mechanism is that subnets with higher price generate more value for the Bittensor network, hence they deserve more TAO emissions.

But let’s be honest. In crypto, the tokens with the highest price are going to be the ones with the most mindshare, hype, ponzi, and marketing. This is why it’s always been L1’s and memecoins that have the highest relative valuations.

The intentions behind the mechanism design are good as it assumes that subnets that create value via generating revenues will use a portion of revenues to buy back SN tokens, hence have higher price, and deserve more TAO emissions. But I think this line of thinking is a little naive.

The memecoin subnet & broken tokenomics

Prior to the launch of dTAO, I was discussing with a few crypto analysts about the obvious flaw in dTAO tokenomics — namely higher price != higher revenues or higher value creation.

But little did I know, theory would come into practice right away. The free market works in beautiful ways.

Right before the upgrade, an anon took over Subnet 281 and turned it into a memecoin subnet named “TAO Accumulation Corporation” aka “LOL-subnet”. This obviously has nothing to do with AI.

In the (now removed) Github, it said…

Miners do not need to run any code, and validators score miners based on their subnet token holdings. The more a miner holds, the more emissions they receive.

What actually happens here is that speculators buy SN28 token → SN28 price goes up → SN28 gets more TAO emissions → SN28 price goes up (if it breaks the subnet’s token emission limits) + the SN token emissions passed onto “miners” in proportion to how much SN tokens they hold → people buy more SN to get more TAO → higher price → ponzi goes on.

TAO emissions have officially gone to funding… memes! At one point, it was even the subnet with the 7th highest MC.

But why hasn’t SN28 taken over Bittensor? Centralization saved the day.

Within a couple of days, the Opentensor Foundation used their root stake to run customized validator code to incentivize people to dump SN28 tokens, sending it down 98% in a few hours.

Essentially the Foundation acted as a centralized entity to stop what the free market wanted to do with the dTAO mechanism. This centralized takeover is only possible now because there is a slow transition period where the emission mechanism transitions from the old TAO emission mechanism to the new dTAO mechanism.

TAO’s old mechanism and transition to dTAO

TAO’s old mechanism basically allows the 64 validators who have the most TAO staked on SN0 (“root subnet”), to vote on who received TAO emissions.

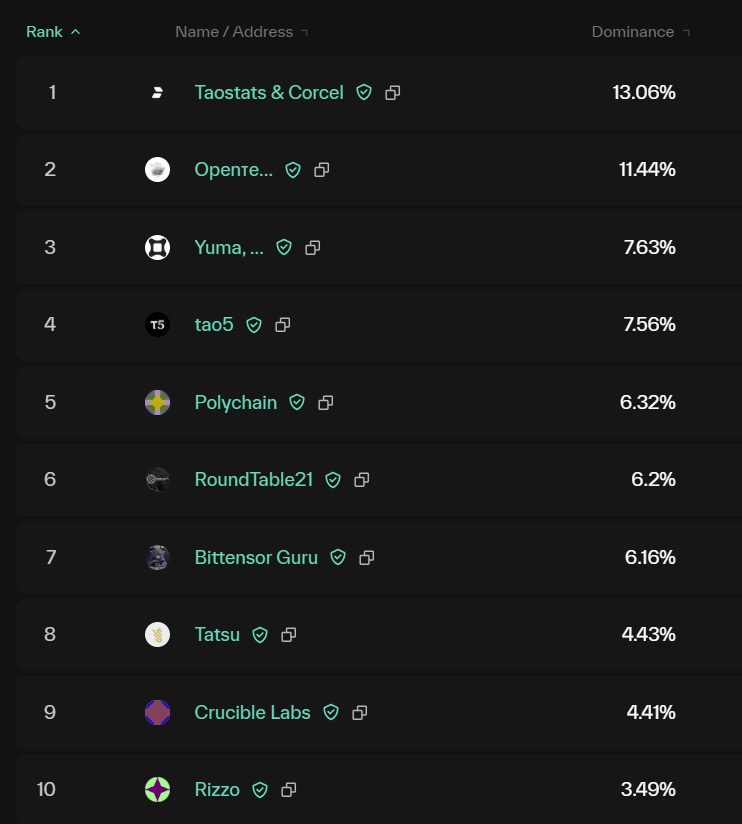

This presented its own set of incentive problems driven by the power the large validators have, such as the Opentensor Foundation, DCG Yuma, Dao5, Polychain, etc.

Many potential conflicts of interest would arise, for example they could in theory direct TAO emissions to subnets which they have invested in or incubated, or to subnets where they run a validator for and are personally receiving TAO rewards for.

Hence, moving away from that is a good step towards decentralization. I applaud the team for choosing a more decentralized reward mechanism, even if it means they could lose out on emissions.

When SN28-fiasco happened, it was only ~1 week into the introduction of dTAO, hence SN0 (blue lne below) still had control of ~95% of emissions, and the Opentensor Foundation could intervene.

In ~1y, the power of SN0 to direct emissions diminishes to about ~20%. This means that if something like SN28 takes off again, it is unlikely that anyone can intervene via SN0. In this case, Bittensor could cease from being a “decentralized AI” project, but a memecoin incentivization network.

Let’s say it’s not all memes

Even if we assume that people are altruistic enough not to ape into memes in this bear market, there is a good chance that Bittensor might become a generalized incentivization network, completely unrelated to AI.

Consider the thought experiment where someone launches a subnet specifically to mine Bitcoin in a decentralized manner (This is not a very novel idea). The idea is for the subnet to incentivize mining bitcoin in a resource efficient manner, while using the BTC mined as recurring revenues to buyback their SN token to receive TAO emissions.

Hence, TAO goes from a decentralized AI project to a generalized incentivization project, where TAO emissions just goes to substitute the most random OpEx costs of businesses, instead of advancing towards a specific goal.

This should technically be a-okay given that the Yuma consensus mechanism was meant to form consensus around any “subjective” work, which need not be AI. But the lack of this specific goal kind of makes it all.. very much pointless.

Final thoughts

We’re only 1 month in and the cracks are already showing in the new dTAO model.

The free market incentives dictates that without any centralized force, Bittensor could stop being an AI project, but an “attention network” dominated by memecoin subnets, or a “generalized incentive network” dominated by revenue-generating businesses subsidizing their OpEx with TAO emissions without improving the Bittensor network.

I think what the network works is one true “objective function” which could align all subnets to a singular goal. However, it is obviously quite difficult to have one true objective in AI (AGI?) as we’ve seen how difficult it is to run fair LLM evaluation frameworks…. which is why the Yuma consensus for “subjective” work was created in the first place…

Tell me the incentives and I’ll tell you the outcome. Peace!

Disclaimer: This post is for general information purposes only. It does not constitute investment advice or a recommendation or solicitation to buy or sell any investment and should not be used in the evaluation of the merits of making any investment decision. It should not be relied upon for accounting, legal or tax advice or investment recommendations. This post reflects the current opinions of the author and does not necessarily reflect the opinions of the author’s employer. The opinions reflected herein are subject to change without being updated.

SN28 used to be Foundry’s S&P500 Oracle subnet (for making price predictions for the S&P500 index), but somehow got bought over (?) by an anon

instructions unclear: should I long or short TAO?