Sharing some jumbled thoughts as we broke all-time highs and have been chopping for a bit:

The consensus among investors seems to be a bull market until Q4 this year, though conviction was not as strong as in Dec/Jan. Hence now is an awkward timing for startup fundraising as token projects typically have a 6-12-month lock-up with 2-4 years of vesting, meaning investors would vest into a bear market. Some good investors are already preparing for the next cycle.

Private markets are still overheated — high volume of low quality deals, and good deals being priced expensively (we’re talking $100-500M FDV for pre-product protocols, especially in AI). Part of the reason is also because deals are getting benchmarked against some coins trading at high FDVs, without effectively pricing in lock-ups and illiquidity discounts. Regan wrote a great thread about this.

The (in)famous money flow and path to “alt-season” this cycle will be muted given BTC price movements were largely driven by the Bitcoin ETF. These Bitcoin ETF gains could flow to a future Ethereum ETF, but not to alts since you can’t buy your favourite alts through the same stock broker.

It seems like we went straight from Bitcoin to Solana memecoins and skipped everything in between. But it’s actually two separate things. The Bitcoin rally brought excitement to Ordinals, BRC-20’s and Runes on the retail side and Bitcoin “L2s” on the private side, while it was the Solana rally that brought attention to memecoins, starting a positive feedback loop. You should know that every VC that wants exposure to Solana already has exposure by now, whether that’s through open markets, funding Solana protocols, or through the FTX estate.

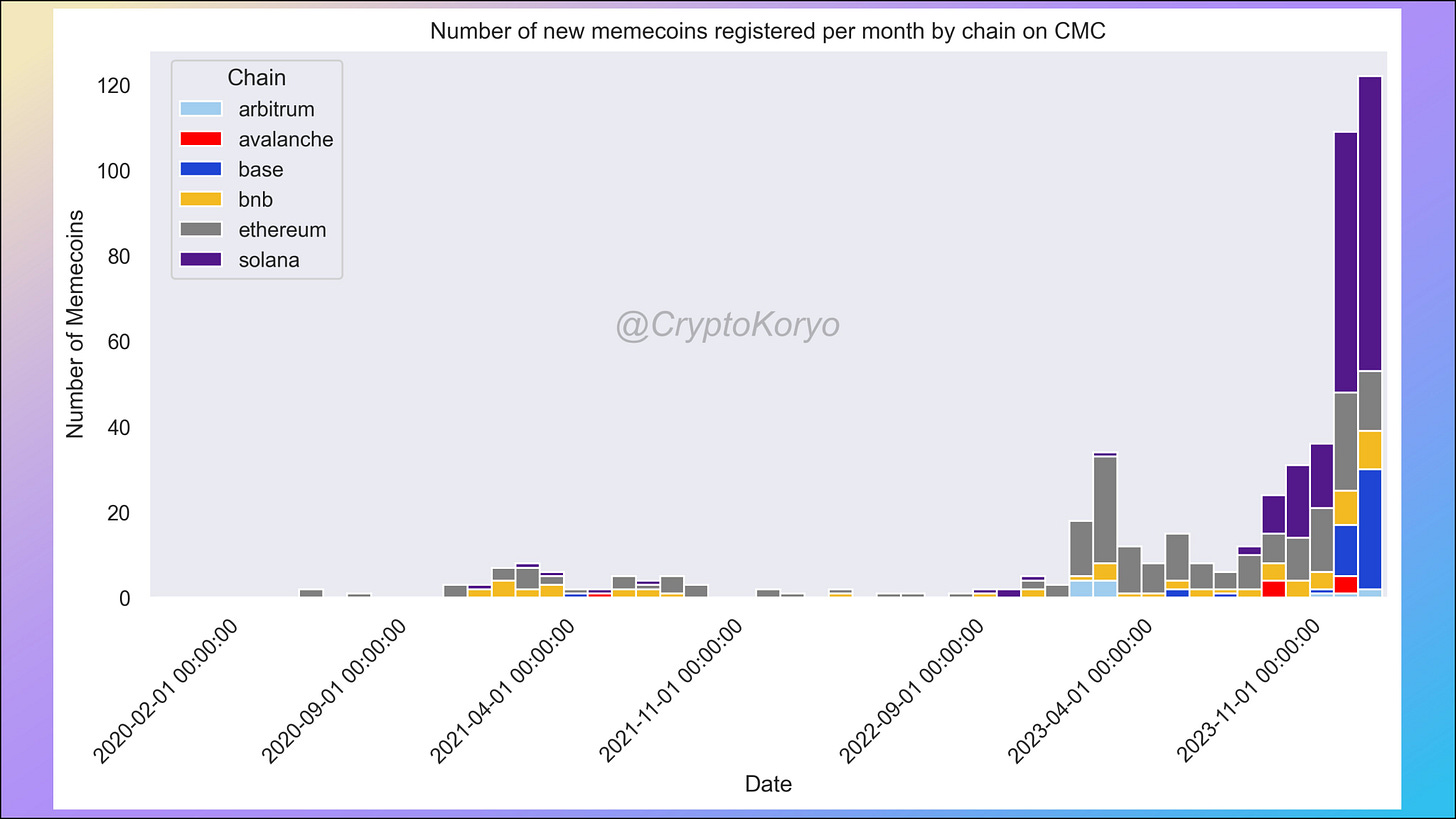

Memecoin supply has far outstripped the demand. It’s now too easy to deploy new tokens with pump.fun and there are just too many new memes gunning for attention. Unless you’re in the trenches sniping new memecoins, it’s much better r/r to long your favourite mid-to-large cap memes. And for the love of god, please unfollow influencers, you are just their exit liquidity. (Or follow them to see what coins to avoid).

Only ~10% of coins are registered on Coinmarketcap, but it’s directionally correct. (Source: CryptoKoryo) The two biggest things on Ethereum right now are Eigenlayer and Ethena. The market loves anything that generates high yield and looks somewhat novel technically so in hindsight the hype that followed was a no-brainer. I kinda worry that there isn’t enough innovation on Ethereum.

It remains to be seen if Eigenlayer ($EIGEN) can generating sustainable yield from the AVS. Even if we assume the tech runs smoothly, there is still a possibility that users will withdraw en masse after the airdrop period, when they realise they’re only getting a few % above “risk-free” staked ETH yield. I generally wouldn’t recommend farming Eigenlayer and LSTs if you’re not a whale, as they’re way too over-farmed.

Ethena ($ENA) is just a tokenised hedge fund marketed as a “stablecoin”. It’s basically if Jane Street had a fund that does basis trading, tokenised it at $1 per share and let it trade without KYC. I think it’s a great crypto-native way to “tokenise a fund” and create a stablecoin not dependent on traditional banking rails, but the 60%+ yields were clearly not sustainable (seems like it’s dropped now to ~15%). I think it’s great we had Luna so everyone is watching any “stablecoin” very closely. IMO the key risk here is getting wrongfully liquidated on weird CEX wicks, even if they use Clearloop etc., but they do have good relationships with CEXs.

The other two most active ecosystems are Solana (memecoins) and Base (consumer apps). I think Solana has successfully graduated to become a religion, joining ETH and BTC. I really enjoy seeing cool stuff being built on Base like CryptoTheGame, Farcaster, and Fantasy.top. Blast and Berachain are hyped but seem too PvP to me. Other ecosystems I’m watching are Sui, Ton, and the aoComputer. (+ Monad whenever that launches)

There is this meme that in bull markets, FDV is a meme and Market Cap is king. This makes sense because inflows of capital buying is typically a lot higher than the token inflation rate. But if you’re buying into the typical “VC coin” that is low-float high FDV, be wary of unlocks + airdrop dumping. It’s really hard for markets to absorb unlocks, eg with the upcoming STRK, AEVO, and ARB hitting the markets 15-16 May.

“Tell me the incentives and I’ll tell you the outcome”. There is a huge incentive (mis)alignment problem as token vesting for team and investors is based on time (“1y cliff + 2y vest”) instead of milestone-based. This means there are many mercenary teams that (i) optimise for launching a token asap to start the vesting clock, (ii) optimise for KOL rounds and marketing instead of the product to increase token prices during unlocks, and (iii) are short-term oriented instead of creating long-lasting value and cashflows over a 5-10y horizon. I think this is the single biggest problem in crypto that needs to be fixed before we can go anywhere.

I think most “airdrop farming” is really negative EV unless you’re a whale, this includes Eigenlayer, LSTs, and the long list of Solana protocols (MarginFi, Drift, Kamino, etc.). The handful of protocols I think are worth playing around with (“farming”) now are the ones that are harder to “farm”, such as providing compute to decentralized inference protocols or using the aoComputer which requires using CLI. But more importantly, just go out and play with different protocols with no expectation of returns, that’s much better for your mental health lmao

Portfolio construction is one of the most important aspects but still seems overlooked. Assuming a sub a 5-6 fig portfolio, and the goal to 10x it, it makes more sense to have 3-4 concentrated bets (15-20% each) instead of a basket of 20 assets because it’s much easier to keep track and your size should accurately reflect your conviction. More importantly, if any one coin does a 10-15x then you double your portfolio (an amount I assume would be meaningful).

You should always hold a % of your portfolio in BTC or ETH. This % depends on the size of your portfolio — larger portfolio and more risk-averse = more BTC/ETH, say +50%. If you’re still feeling sidelined (what are you doing?!), just market buy ETH and deploy from ETH.

A good heuristic to “do I buy now?” is to compare the pain of a [50%] down move vs a potential [5-10x] up move. Replace the brackets with your numbers. Which one feels worse?

Embrace speculation. Most of crypto is just a huge casino because this is exactly what the underlying tech enables — crypto is the “internet of value” and people from across the globe can agree that the digital thing they are trading are the same and is provably scarce.

I am cautiously optimistic — the BTC ETFs are starting to see outflows, the ETH ETF is almost certainly delayed especially due to the Consensys v SEC lawsuit, and we’re still lacking a novel primitive for speculation. We had the ICO of 2017, DeFi yield farming of 2020 and NFTs of 2021, but nothing truly novel in 2024 — memecoins have been around since the $DOGE days. This is the bull run we don’t deserve. I am optimistically hoping something novel comes out of AI, Social, DePIN.

If you enjoyed this commentary, drop me a “like”, it’s cheaper than buying me a coffee 👀. Thanks for reading!