Who am I? I’m Tze Donn. I’m a Web3 investor at Tioga Capital. I love all things tech, finance, and Web3. Every month, I send out a newsletter about my information diet, encompassing Stablecoins & FinTech, Investing, and Lifestyle. Hit “reply” or comment if you wanna chat about anything below.

It’s been a crazy month. The irrational exuberance of the markets seems to be on the rise once again. We’re marching ever closer to a Bitcoin ETF, the Bitcoin halving is nearing, and interest rates seem to be declining. Builders are still building, and investors are putting money on the craps table.

Investing, Social Networks & AI

In 1997, Reid Hoffman, a 30 y/o with two degrees (Stanford & Oxford) raised $22M from St Paul, Accel, and Primedia for his startup SocialNet.com. The venture failed by 2000 and he goes and help build Paypal alongside Elon Musk and Peter Thiel. In Dec 2022, he started LinkedIn but none of his previous investors invested. 14y later, LinkedIn was sold to Microsoft for $26B. St Paul VC and Primedia might have thought they were invested in Reid Hoffman, but their insolvency says otherwise. Can VCs buy shares of people?

There has been so much hype around Crypto x AI coins - obviously 99.9% of these are pure scams. The two areas I’m somewhat interested in are clustering of unused GPUs for inference (or potentially train models) and AI “agents” that can transact on chain. Here’s an example of the latter, using Autonolas.

Portfolio construction matters in Early Stage Investing. You can only win (and win big) if you choose the right company and own a large enough chunk of it. Focus on what can go right. Focus on platforms and networks. Focus on the Founder’s clarity of thought and “killer” founders. The Art of Early Stage Investing by Rex Woodbury (Daybreak Fund).

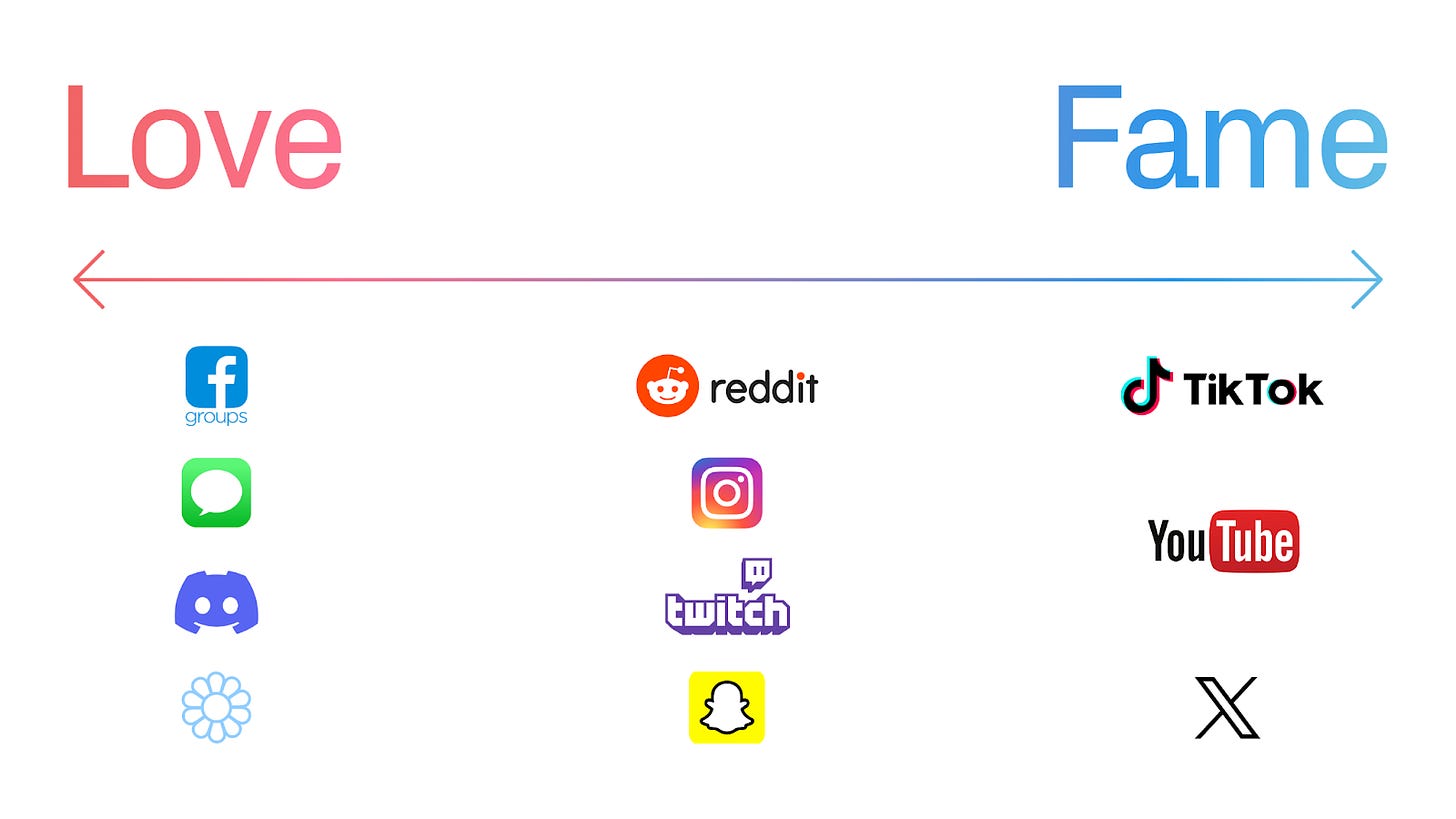

There is social networking (“love”) and social media (“fame”). Web2 platforms started with social networking (1-1 comms), but when those network effect saturated (you’ve already connected with everyone you know on Facebook), they moved to “fame” to make you follow people you don’t know, in order to pursue growth. Crypto could allow more ownership-based “love” networks. Here’s a Framework for Social Applications by Li Jin.

Stablecoins, FinTech & Money

The world’s most successful network effects are the Visa and Mastercard networks. How do you overcome these? Square. By bringing their Square and Cash App ecosystems together, Block is attempting to build the Holy Grail of payments — a closed-loop payments network.

Not many know that SWIFTnet is widely used for domestic payments, particularly in Australia, Canada, UK, Singapore, New Zealand, Nigeria, Sweden and South Africa. Are Central Banks too reliant on SWIFT?

Life & Misc.

Learn everything and just do it. Really. Just Do It. Things you learn dating Cate Hall by her husband, Sasha Chapin. Very simple and motivational.

The average number of workers at an S&P 500 company needed to generate $1M in top-line has halved from four in 2000 to two in 2023 (though this likely doesn’t mean you’ll work fewer hours). In other news, among Millenials, LGBTQ+ identification hovers at ~10%, but among Gen Z, it’s twice that (10% in 2017 vs 21% in 2021). Absolutely insane. 10 Charts That Capture How the World Is Changing (Rex Woodbury).

What the longest-running study on happiness reveals.. TLDW? Exercise & relationships.

If you enjoyed reading this issue, you can “like” this newsletter by clicking the ❤️ below, which helps me get visibility on Substack.

Thanks for reading!

Donn